2 Tips – How to manage your time more effectively II Angelo Mathews II ICC Men’s World Cup 2023

Introduction

If you’ve ever wondered what it takes to become a Corporate Agent in the world of insurance in Bharat (India), you’ve come to the right place. In this article, we’ll break down the complicated regulatory stipulations into a clear and straightforward guide. So, let’s find out the regulatory stipulations!

Who is a Corporate Agent?

First things first, let’s define who a Corporate Agent is. In the context of insurance, a Corporate Agent is any entity or person authorized by the regulatory authority (IRDAI) to solicit and service insurance business. This business can fall under specific categories, including life, general, and health insurance.

Who Can Become a Corporate Agent?

To become a Corporate Agent, you need to meet specific criteria. Here’s who is eligible:

The Registration Process

Now, let’s walk through the steps of registering as a Corporate Agent:

1. Submission of Request for Login Credentials: Begin by submitting a request for login credentials.

2. Required Documents for Login Credentials: You’ll need to upload specific documents, including:

3. Login to the Portal: Once you have your login credentials, log in to the Corporate Agency Portal.

4. Upload Checklist and Required Documents: Upload the necessary documents to obtain your Certificate of Registration (after approval by the IRDAI (Authority) and payment of the requisite fee). These include items like your company profile, organizational structure, net worth certificate, and more.

5. Compliance Documents: Prepare and submit various compliance-related documents, such as training, examination records, and code of conduct.

6. Infrastructure Documentation: Provide documents that support your infrastructure, including lease agreements, equipment, and manpower details.

7. Business Plan: Outline your business strategy and plan for procuring insurance business.

8. Declarations: Make declarations regarding FDI in your entity, the appointment of a Principal Officer (PO), and registration with other regulators if applicable.

9. Financial Projections: Provide projected Profit and Loss (P&L) and Balance Sheet for the next three years and audited financial statements for the last three years.

Remember, this list is not exhaustive, and the regulatory authority may request additional information as needed.

Activities After Registration

Once you’ve successfully registered as a Corporate Agent, there are additional activities to consider:

Understanding the Fees required for registration:

Before you begin, it’s essential to know the fees involved in the registration process:

Conclusion

Becoming a Corporate Agent in the insurance industry is a structured process with specific requirements as stipulated by the IRDAI, which is the Insurance Business regulator. Following the steps outlined in this guide and providing the necessary documentation, you can navigate the registration process and start your journey as a Corporate Agent.

Remember, the regulatory authority may have additional requirements, which a regulator may ask. Hence, one needs to be prepared to handle such situations.

Thank you.

#UpskillwithAbhishek

In April 2023, the Reserve Bank of India introduced measures to enhance the services provided by Credit Information Companies (CICs) and Credit Institutions (CIs). The goal is to ensure customers receive better assistance and address their grievances effectively.

If you recall, recently, RBI has penalized a few Banks for wrong reporting of your credit data with CICs especially in the Credit Card business segment.

In the exercise of the powers conferred in the Credit Information Companies (Regulation) Act, 2005 (CICRA, 2005), the Reserve Bank of India directs CICs and CIs to implement the directions as detailed below:

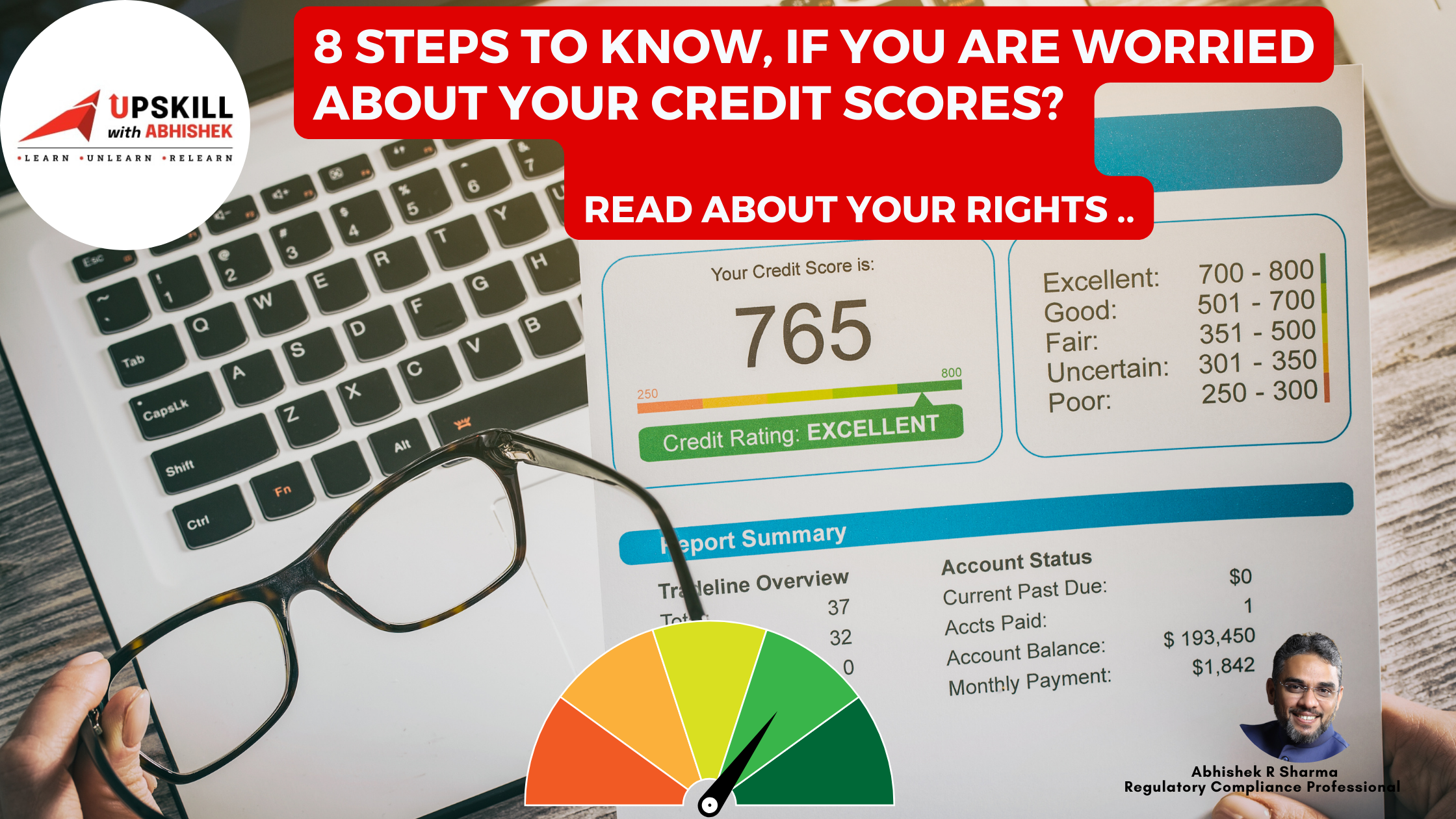

What you should know?

1. Notification of Credit Report Access

CICs will now send SMS or email alerts to customers whenever their Credit Information Report (CIR) is accessed by specific users (such as Banks, NBFCs, approved Fintechs, etc). This notification will be sent if the customer’s mobile number or email is available. CIs will notify customers through SMS or email when reporting default or Days Past Due (DPD) in existing credit facilities.

2. Nodal Points for Customer Grievances

CIs must designate a dedicated point of contact for CICs to handle customer grievances. They will share the contact details of this official with CICs and update any changes within five days.

3. Identifying Complaint Root Causes

CIs are now required to perform a Root Cause Analysis (RCA) of customer grievances at least semi-annually. This analysis will help them understand the reasons behind the complaints. The results of this analysis will be reviewed by top management annually.

4. Explaining Data Correction Rejections

If a customer’s request for data correction is rejected, CIs will explain the reasons for the rejection. A list of common rejection reasons will be provided by CICs to all CIs.

5. Review of Credit Report Matching Logic

CICs will periodically review their ‘Search & Match’ logic algorithm to provide Credit Information Reports (CIRs) for borrowers. Any issues identified during the RCA of complaints will be addressed by the Board of Directors of the CIC.

CICs shall have a board-approved policy for undertaking periodic review (at least on a half-yearly basis) of the ‘Search & Match’ logic algorithm implemented by them to provide a Credit Information Report (CIR) of a borrower.

6. Timely Data Ingestion

CICs will promptly ingest credit information data received from CIs into their databases within seven calendar days.

If data is rejected, CICs will communicate the reasons to the concerned CI within seven calendar days.

7. Disclosure of Complaints and Framework for compensation to customers for delayed updation/ rectification of credit information

CICs will publish details of complaints registered against them and CIs on their websites in a specific format.

Furthermore, the Reserve Bank of India directs CICs and CIs to implement the compensation framework for delayed updation/rectification of credit information by CIs and CICs.

You as Complainants shall be entitled to a compensation of ₹100 per calendar day if your complaint is not resolved within thirty (30) calendar days from the date of the initial filing of the complaint by the complainant with a CI/ CIC. The complainant can approach the RBI Ombudsman, under the Reserve Bank – Integrated Ombudsman Scheme, 2021, in case of wrongful denial of compensation by CIs or CICs.

8. Free Full Credit Report Access

CICs will provide individuals with easy access to their Free Full Credit Report, including their credit score, once a year. This will be prominently displayed on the CICs’ websites.

These measures will be implemented six months from the date of the circular.

Failure to comply may result in penalties as per the Credit Information Companies (Regulation) Act, 2005 (CICRA, 2005).

This initiative aims to provide better service and transparency for customers dealing with credit information.

Thank you.

Stay Updated, and Be Aware of your financial rights and obligations.

#UpskillwithAbhishek

✍ A second edition of the HARBINGER 2023 hackathon, themed “Inclusive Digital Services,” has been launched by the Reserve Bank of India (RBI), in an exciting display of global fintech innovation.

✍ Teams in India and across the globe responded well to this initiative, which aims to develop cutting-edge solutions for financial transformation.

Key Takeaways:

🤖 Global Participation: The hackathon attracted a diverse pool of innovators, with 154 proposals submitted by teams from India, as well as 28 international teams/entities from Australia, Canada, Germany, Singapore, Sweden, the UK, and the USA.

🤖 Three Phases of Innovation: The competition unfolded in three phases, commencing with proposal shortlisting, followed by solution development, and culminating in the final evaluation.

🤖 Innovation Across Four Problem Statements: A panel of external experts shortlisted 28 proposals addressing four problem statements.

🤖 Diverse Solutions: The innovative solutions catered to the differently-abled, streamlined regulatory compliance, explored new use cases for Central Bank Digital Currency (CBDC-R) and improved the scalability of blockchains.

🏆 Winners and Runners-Up: The esteemed panel of judges and an independent jury selected the following winners and runners-up:

Problem 1: Innovative Digital Banking Services for Differently Abled

🏆 Winner: Ezetap Mobile Solutions Pvt Ltd (Now acquired by Razorpay), India

Joint Runners-up: PoSMirror, India, and SL Avatar, India

Problem 2: RegTech Solutions for Compliance

🏆 Winner: WeavAir, Singapore

Runner-up: Munafa, India

Problem 3: CBDC-R Transactions

🏆 Winner: Dygnify Ventures Private Limited, India

Runner-up: Crunchfish Digital Cash AB (Sweden) + IDFC First Bank (India)

Problem 4: Blockchain Scalability

🏆 Winner: Fortis Net Ltd., UK

🤚 Implications: These groundbreaking solutions promise to enhance the financial ecosystem by ensuring inclusivity for the differently-abled, facilitating efficient regulatory compliance, advancing CBDC-R use cases, and boosting blockchain scalability.

These game-changing innovations, while subject to regulatory compliance, hold the potential to bring ease, accessibility, efficiency, and inclusion to the financial services sector. I’d like you to please stay tuned for the transformation these solutions will bring to the world of finance.

——————————————-

I’m Abhishek. 😊

I post 3-4 times a week on Financial Services, Mindfulness & Research.

Purpose to help #Upskill ✍ & #Enable #You to the fullest.

Stay connected 🤝 . Like, Repost & Collaborate.

#UpskillwithAbhishek

*Views are personal.